An Input Tax Credit is available any time a GST registered entity makes a creditable purchase. That means the purchase relates to something for predominantly business use, and that the purchase is substantiated by a Tax Invoice. That applies to most purchases a dealer will make, except for those stock items acquired from private individuals who do not provide a Tax Invoice.

In the absence of a Tax Invoice there is no direct entitlement to an ITC for the purchase, so a workaround has been legislated by the ATO. This is referred to as a Notional ITC whereas when a Tax Invoice is received the ITC is referred to as an Actual ITC.

An Actual ITC entitles the entity to claim 1/11th of the Taxable value of the purchase as an Input Credit.

In contrast a Notional ITC entitles the dealer to claim "1/11th of the Purchase Price or the GST payable on sale, whichever is the lesser".

Some Worked Examples

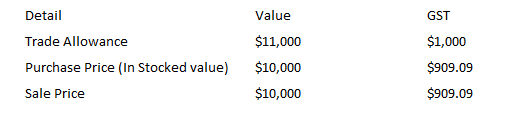

![]() Notional Stock Item acquired as a Trade

Notional Stock Item acquired as a Trade

When a Stock Item is acquired as a Trade, the Trade Allowance - that shown on the contract signed by the customer - is used as the Purchase Price.

In this example, because the stock item has been sold for less than the Purchase Price, the ITC claimable is $909.09. Unfortunately the amount of $91 has been lost from this deal because of the Notional status. |

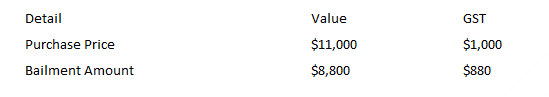

![]() Notional Stock Item on Floor Plan

Notional Stock Item on Floor Plan

Because placing a stock item on Floor Plan (Bailment) raises a GST Sale, If a Notional Stock Item is bailed, the ITC is capped to the GST payable on the bailment entry. In this example, because the stock item has been bailed for less than the Purchase Price, the ITC claimable is only $880. |

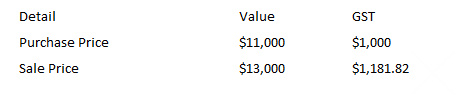

![]() Notional Stock Item sold Retail

Notional Stock Item sold Retail

Provided the stock item is sold for more than the purchase price, the full available ITC can be captured.

In this example, the full amount of $1,000 can be claimed as an ITC because the GST payable on the sale is greater. |

Notional GST in Accounting

Because the ITC is not available until sale, the GST Inclusive value of the stock item is taken up in the Stock on Hand Asset account. When the stock item is sold, the Sales Journal calculates the ITC. The Stock on Hand account is credited with the full GST Inclusive value, the Cost of Sales - Vehicle Purchases account is debited for that amount less the calculated ITC, and the GST Paid account is debited with the Calculated GST. The value of the ITC calculated can be seen from the Purchase tab of the stock card, and from the 2nd page of the printed Financial Details, available via the Printer icon on the stock card.