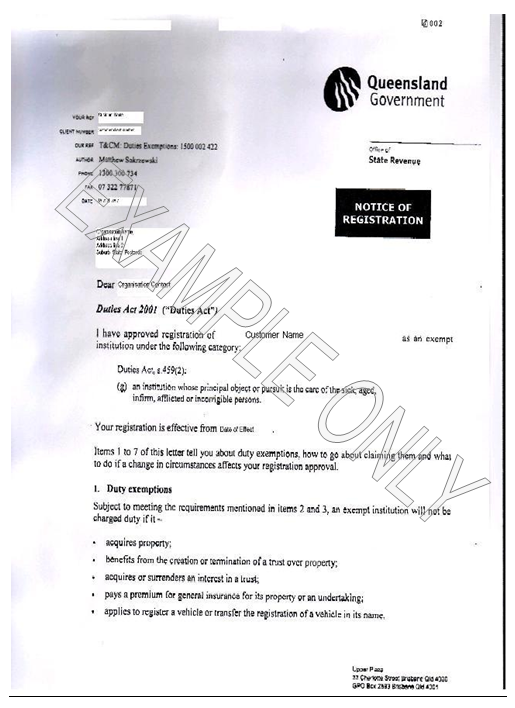

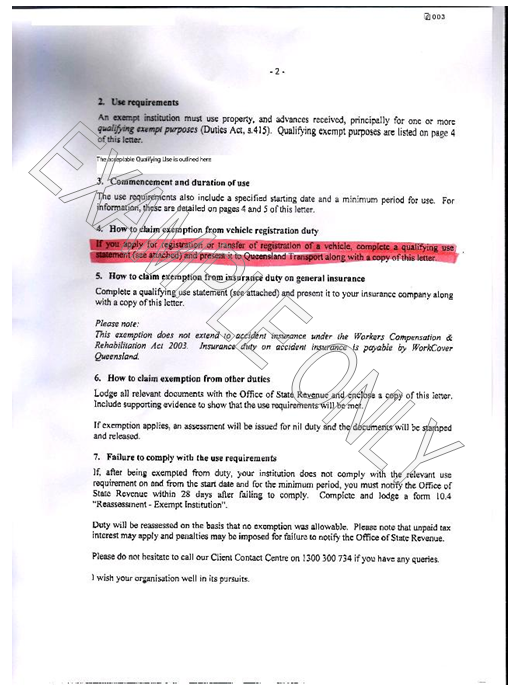

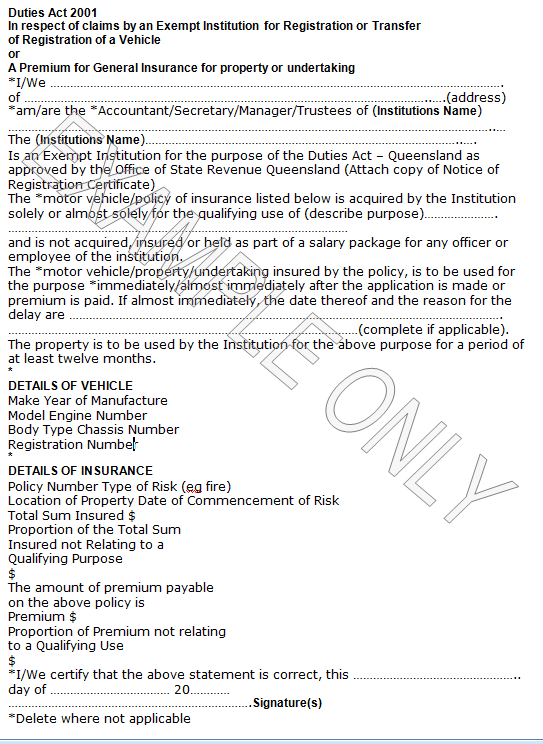

These usually are legal entities, which have established their duty exemption status with the Office of State Revenue. As such, there are two documents that you will need to process their transactions with this exemption: a Certificate of Exemption and a Qualifying Use Statement (see example) or the new Notice of Registration issued by the Office of State Revenue and a qualifying use statement.

It is imperative that the name on the certificate matches the name of the registration.

The exemption category that you will select is ‘Qualifying Institute’ from the combo on the Rego Detail tab. After your transaction is complete, copies of the Certificate of Exemption and Qualifying use statement or the Notice of Registration need to be posted with a copy of the Transaction Application to the Office of State Revenue, as well as going with your TRAILS filing.

Certificate of Exemption Example

Qualifying Use Statement Example

Notice of Registration example