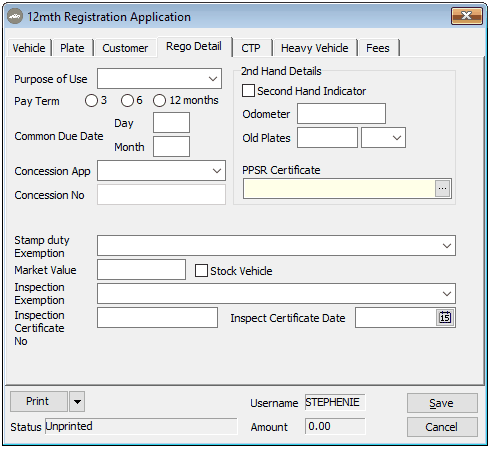

Rego Detail Tab:

Purpose of Use – Choose the appropriate Purpose of Use using the combo field. The purpose of use ties in with the type of customer, and also the CTP Class. It also has some relevance to the Concession claimed. For example, some concessions such as Pensioner cannot use their concession to claim reduced fees where the purpose of use is not private. Similarly an organisation cannot have a purpose of use of Private.

Pay Term – 6 or 12 months Note: your usual preference for new and used vehicle registrations can be recorded permanently in Registration Defaults, located under the Admin, Program Config menu. Alternatively you can select the preferred option for Pay Term in this field.

Common Due Date

A customer with more than 5 vehicles registered in its CRN can apply to Queensland Transport for a common expiry date. This date will be expressed as day/month. The registration will then be applied up until this expiry date. If the transaction date for the registration means that there would be less than 2 months registration applied, the registration will be automatically processed until the common expiry date of the following year, so in some cases it will be for a period greater than 12 months.

The Motor Vehicle, Traffic Improvement & Compulsory Third Party insurance fees will all be calculated on a pro-rata basis. The fees due for a common due date transaction can be determined by using the Quick Quote feature on the QT menu, or check the Fees tab of the registration transaction. Both these screens will highlight the expiry date and indicate the term of the registration.

Concession

Always look at the ‘deal’ to check whether a concession should be claimed. If you forget it, QT won’t do it for you.

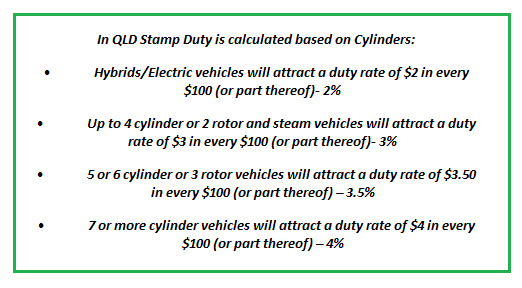

Stamp Duty Exemption

Always check whether a Stamp Duty Exemption should be claimed. If the purpose of use for the vehicle is Dealer then your stamp duty exemption reason will default to Licensed Motor Dealer (Normal Course of Business).

Odometer – If the vehicle has been previously registered, you are required to complete the odometer reading field.

Market Value - This field represents the total retail value of the vehicle including all fitted accessories. The market value for new vehicles must be based on the List Price of the vehicle before discounts and the List Price of fitted accessories before discounts. Note that other extras that may form part of the sales contract do not form part of the market value unless they are actually fitted to the vehicle. This means items such as Extended Warranty, Dealer Delivery Fee, Title Check etc do not form part of the market value.

New Vehicles – Recommended Retail Price + Fitted Accessories

Used Vehicles – Contract of Sale Price + Fitted Accessories

In QLD, You do not need to round the market value to the next $100 as Dealerlogic will do that for you. Note however, that the rounding is always up to the next $100, not to the nearest $100.

Note: You are not required to enter a market value if the vehicle is being registered to your dealership (the ‘Main Dealership’ Demo). If the stamp Duty is exempt for any other reason you are still required to enter a Market Value.

If registering a used vehicle to a customer you are required to supply details of a Valid RWC.